- 1. Meet Professor William Sharpe

- 2. A first glance at the data

- 3. Plot & summarize daily prices for Amazon and Facebook

- 4. Visualize & summarize daily values for the S&P 500

- 5. The inputs for the Sharpe Ratio: Starting with Daily Stock Returns

- 6. Daily S&P 500 returns

- 7. Calculating Excess Returns for Amazon and Facebook vs. S&P 500

- 8. The Sharpe Ratio, Step 1: The Average Difference in Daily Returns Stocks vs S&P 500

- 9. The Sharpe Ratio, Step 2: Standard Deviation of the Return Difference

- 10. Putting it all together

- 11. Conclusion

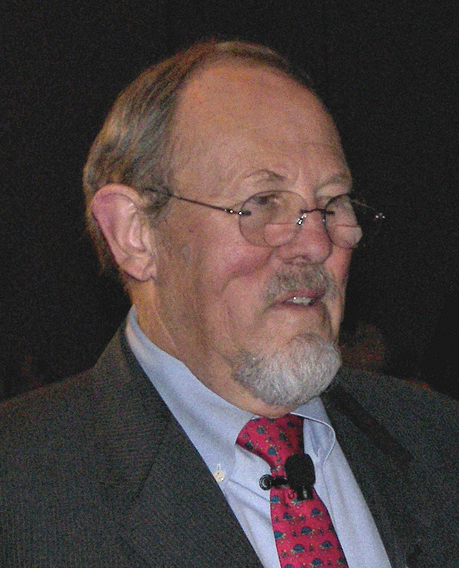

1. Meet Professor William Sharpe

An investment may make sense if we expect it to return more money than it costs. But returns are only part of the story because they are risky - there may be a range of possible outcomes. How does one compare different investments that may deliver similar results on average, but exhibit different levels of risks?

Enter William Sharpe. He introduced the reward-to-variability ratio in 1966 that soon came to be called the Sharpe Ratio. It compares the expected returns for two investment opportunities and calculates the additional return per unit of risk an investor could obtain by choosing one over the other. In particular, it looks at the difference in returns for two investments and compares the average difference to the standard deviation (as a measure of risk) of this difference. A higher Sharpe ratio means that the reward will be higher for a given amount of risk. It is common to compare a specific opportunity against a benchmark that represents an entire category of investments.

The Sharpe ratio has been one of the most popular risk/return measures in finance, not least because it's so simple to use. It also helped that Professor Sharpe won a Nobel Memorial Prize in Economics in 1990 for his work on the capital asset pricing model (CAPM).

The Sharpe ratio is usually calculated for a portfolio and uses the risk-free interest rate as benchmark. We will simplify our example and use stocks instead of a portfolio. We will also use a stock index as benchmark rather than the risk-free interest rate because both are readily available at daily frequencies and we do not have to get into converting interest rates from annual to daily frequency. Just keep in mind that you would run the same calculation with portfolio returns and your risk-free rate of choice, e.g, the 3-month Treasury Bill Rate.

So let's learn about the Sharpe ratio by calculating it for the stocks of the two tech giants Facebook and Amazon. As benchmark we'll use the S&P 500 that measures the performance of the 500 largest stocks in the US. When we use a stock index instead of the risk-free rate, the result is called the Information Ratio and is used to benchmark the return on active portfolio management because it tells you how much more return for a given unit of risk your portfolio manager earned relative to just putting your money into a low-cost index fund.

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

# Settings to produce nice plots in a Jupyter notebook

plt.style.use('fivethirtyeight')

%matplotlib inline

# Reading in the data

stock_data = pd.read_csv('datasets/stock_data.csv', parse_dates=['Date'], index_col='Date')

benchmark_data = pd.read_csv('datasets/benchmark_data.csv', parse_dates=['Date'], index_col='Date').dropna()

print('Stocks\n')

stock_data.info()

stock_data.head()

# Display summary for benchmark_data

print('\nBenchmarks\n')

benchmark_data.info()

benchmark_data.head()

stock_data.plot(kind='line', subplots=True, title='Stock Data')

# summarize the stock_data

stock_data.describe()

benchmark_data.plot(kind='line', title='S&P 500')

# summarize the benchmark_data

benchmark_data.describe()

5. The inputs for the Sharpe Ratio: Starting with Daily Stock Returns

The Sharpe Ratio uses the difference in returns between the two investment opportunities under consideration.

However, our data show the historical value of each investment, not the return. To calculate the return, we need to calculate the percentage change in value from one day to the next. We'll also take a look at the summary statistics because these will become our inputs as we calculate the Sharpe Ratio. Can you already guess the result?

stock_returns = stock_data.pct_change()

# plot the daily returns

stock_returns.plot(kind='line')

# summarize the daily returns

stock_returns.describe()

sp_returns = benchmark_data.pct_change()

# plot the daily returns

benchmark_data.plot(kind='line')

# summarize the daily returns

benchmark_data.describe()

excess_returns = stock_returns.sub(sp_returns, axis=0)

# plot the excess_returns

excess_returns.plot(kind='line')

# summarize the excess_returns

excess_returns.describe()

# ... YOUR CODE FOR TASK 8 HERE ...

avg_excess_return = excess_returns.mean()

# plot avg_excess_returns

avg_excess_return.plot.bar(title='Mean of the Return Difference')

9. The Sharpe Ratio, Step 2: Standard Deviation of the Return Difference

It looks like there was quite a bit of a difference between average daily returns for Amazon and Facebook.

Next, we calculate the standard deviation of the excess_returns. This shows us the amount of risk an investment in the stocks implies as compared to an investment in the S&P 500.

sd_excess_return = excess_returns.std()

# plot the standard deviations

sd_excess_return.plot.bar(title='Standard Deviation of the Return Difference')

10. Putting it all together

Now we just need to compute the ratio of avg_excess_returns and sd_excess_returns. The result is now finally the Sharpe ratio and indicates how much more (or less) return the investment opportunity under consideration yields per unit of risk.

The Sharpe Ratio is often annualized by multiplying it by the square root of the number of periods. We have used daily data as input, so we'll use the square root of the number of trading days (5 days, 52 weeks, minus a few holidays): √252

daily_sharpe_ratio = avg_excess_return.div(sd_excess_return, axis=0)

# annualize the sharpe ratio

annual_factor = np.sqrt(252)

annual_sharpe_ratio = daily_sharpe_ratio.mul(annual_factor)

# plot the annualized sharpe ratio

annual_sharpe_ratio.plot.bar(title='Annualized Sharpe Ratio: Stocks vs S&P 500')

11. Conclusion

Given the two Sharpe ratios, which investment should we go for? In 2016, Amazon had a Sharpe ratio twice as high as Facebook. This means that an investment in Amazon returned twice as much compared to the S&P 500 for each unit of risk an investor would have assumed. In other words, in risk-adjusted terms, the investment in Amazon would have been more attractive.

This difference was mostly driven by differences in return rather than risk between Amazon and Facebook. The risk of choosing Amazon over FB (as measured by the standard deviation) was only slightly higher so that the higher Sharpe ratio for Amazon ends up higher mainly due to the higher average daily returns for Amazon.

When faced with investment alternatives that offer both different returns and risks, the Sharpe Ratio helps to make a decision by adjusting the returns by the differences in risk and allows an investor to compare investment opportunities on equal terms, that is, on an 'apples-to-apples' basis.

buy_amazon = True

buy_facebook = True